Top Mistakes When Buying Property in Dubai

When buying property in Dubai, one can experience certain issues, including unexpected expenses, unprofessional brokers, property defects and more. These traps can easily be avoided with the help of preliminary calculating the required fees, snagging and verifying the agent’s credibility.

Important Aspects to Consider When Buying Property

In order to get off to the right start, it is recommended that you conduct your own research regarding the developer, calculate all the required fees in advance, prepare a list of questions for the broker and hire a snagging specialist. By doing this, you will be prepared for any scenarios and will better protect your investment. When reading this article, you will come across the following terms:

<ol><li>Dubai REST is the smart property platform aimed at catering to all real estate players, from investors to developers. It comes in the form of an app and provides real-time information about projects, details about real estate brokers and their performance levels, progress of construction, rental and sale indexes and much more.</li><li>The Real Estate Regulatory Agency (RERA) is a government body which regulates the property sector in Dubai.</li><li>The Dubai Land Department (DLD) is a state-led entity, which handles all matters regarding the legalization of property deals in the emirate.</li></ol>

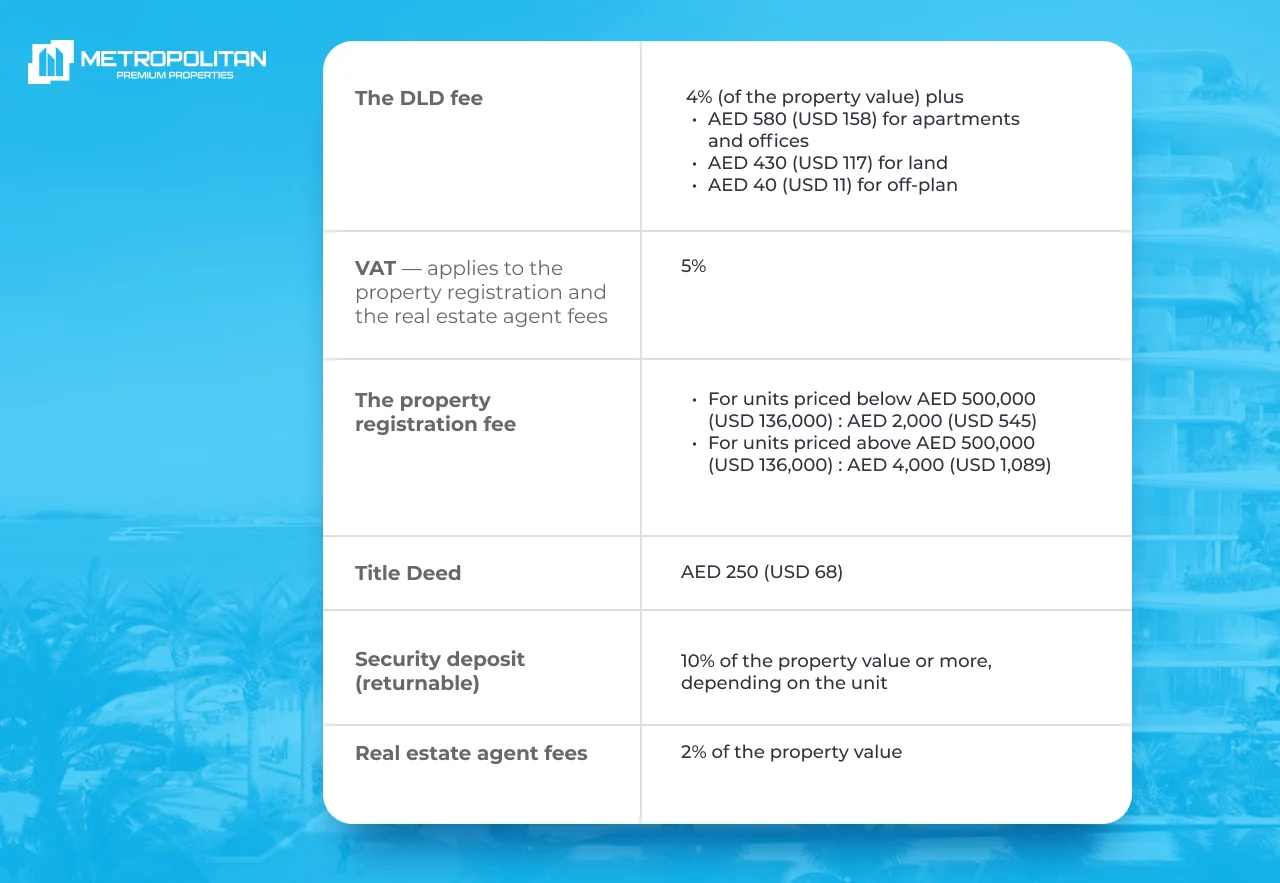

Consider Your Associated Expenses

Frequently, investors are not aware of additional costs associated with property acquisition. Associated expenses include charges levied by real estate agents for their services, government agencies and developers. These make up about 7% of the property value. The following charges are to be paid before the transfer of the title deed: For instance, you have decided to acquire a completed apartment priced at AED 800,000 (USD 218,000). Let’s break down the respective charges: As a result, the estimated total acquisition cost (TCA) of the chosen property amounts to AED 854,000 (USD 232,000).

Research the Developer

When studying the developer online, it is recommended to pay attention to the following aspects:

<ol><li>Percentage of their construction project delays will help you understand how late the property may be handed over to you.</li><li>The amount of properties a developer has in its portfolio is connected to their experience within the industry.</li><li>Complaints filed against the company (e.g. contractual disputes, overall quality of the final build, etc.) will provide an insight into the credibility of the developer and the way it handles issues.</li><li>The segment of the developer’s specialization — if the real estate company specialized strictly in affordable housing previously, and has just started <a href="https://metropolitan.realestate/services/sell/">selling</a> luxury properties, it may not be the best decision to choose this developer, even if the price is appealing. The quality of the property may be lower when compared to similar projects by upscale developers, which puts your investment at risk.</li><li>How other properties by the developer look post-completion — this will give you an understanding of the company’s standard and capabilities. When viewing a completed project in person, you will be able to check the build and finish quality, layout, planning, durability and upkeep. Dubai REST provides inspection photos and reports of completed and off-plan complexes.</li></ol>

NBD! Developers in the UAE are allowed a delay of up to 12 months from the anticipated completion date to the actual handover.

Ask Many Questions

Don’t hesitate to ask a real estate agent as many questions as you can regarding the property. This will help you to not only have a better understanding of your choice, but also to be aware of the level of professionalism from the broker. NBD! In Dubai, agents are required to have a RERA license, the validity which you can verify on Dubai REST. Below is the list of recommended questions to ask the broker:

<ol><li>When is the property available?</li><li>How much are the operating costs?</li><li>Do parking spaces come as part of the total cost?</li><li>Is the development pet-friendly?</li></ol>

For secondary properties it is important to additionally ask the following:

<ol><li>Has the property been upgraded?</li><li>How long has the unit been on the market?</li><li>Why is the owner selling and how long have they lived here?</li></ol>

Pay Attention to the Contract Clauses

It is recommended that you read all clauses in the purchase agreement carefully, so you will not have any unpleasant surprises in the future. For example, if you buy an off-plan property, you have to check if the payment schedule meets the construction stages offered by the developer. Another important thing is determining the completion date and the legal consequences for the developer if it fails to hand over the property on time. Select developers establish a certain amount to be paid before allowing a client to resell an off-plan unit. For example, homeowners of Address Residences The Bay can resell their unit after having paid 40% of its value. There may also be a minimum selling price both for off-plan and ready units, unabling you to sell property below this value.

Check Faults and Defects

Many homebuyers tend to underestimate the importance of inspection and ignore hiring a snagging specialist. Let’s say, you concluded a transaction successfully without any major glitches, and have happily moved into your new home. Soon you find out that you have damp walls, which is not only expensive to fix, but also may mean you have to move out of your home whilst the damp is being eliminated. As a result, you will have to spend money not only on resolving an issue, but on a rental property as well. In this case, snagging is a must to identify any faults and defects in electricity, weak walls, plumbing, etc, enabling you to estimate the value of any repairs. When it comes to an off-plan unit, it is important to check its condition before the handover, as the developer will be liable for all costs to fix any issues. With secondary properties, it depends on the negotiations between a seller and a buyer regarding the party who will take on expenses.

Conclusion

To navigate your way around potential pitfalls of property acquisition, it is recommended to correctly plan your budget, research the developer’s trustworthiness and to read all clauses of the contract before signing it. Another important aspect is snagging, which will help you avoid any extra unexpected expenses in the future.